Social Enterprises

January 19, 2022

The Emerging Trend of Social Enterprises in Thailand

What is a social enterprise?

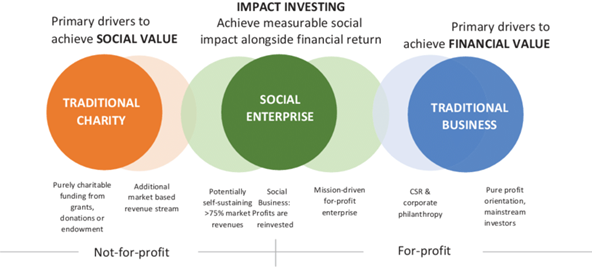

A social enterprise (SE) is a hybrid company with specified social goals as its primary objective, challenging the traditional model of charities and businesses. Profits are primarily utilized to fund social activities, and social enterprises attempt to maximize profits while maximizing benefits to society and the environment.

Core characteristics of social enterprises in Thailand

- A financially sustainable business model, socially and environmentally friendly.

- Operate with transparency and good morals.

- Earn at least 50% of the income from the sale of products or services unless a business that does not wish to share profits with partners or shareholders may earn less than 50% from the sale of goods or services.

- Use at least 70% of profits for social purposes and share profits with business owners or shareholders of not more than 30% of total profits.

- No partner, director or person with power of management on behalf of a juristic person or shareholders holding 25% or more who used to be partners, directors, or managers on behalf of juristic persons or shareholders 25% or more in social enterprise that have been revoked the licenses within the past two years.

The key advantages of social enterprises

- A person who invests in shares in the qualified social enterprise will be exempted for an income tax as paid up to a maximum of 100,000 Baht per year.

- A company who invests in shares in the qualified social enterprise will be exempted for an expense amount equal to shares investment.

- A qualified non-profit sharing social enterprise shall be exempted from corporate income tax on net profits from business operations as prescribed conditions by the Director General of the Revenue Department.

Conclusion

A social enterprise is a business that aims to give back to society in the form of an enterprise that will focus on distributing income to the production units in the social group, taking into account social responsibility, fairness, sharing, and disseminating information. Furthermore, based on our experience, because of tax exemption, operating as a social enterprise might be advantageous for a person or firm that wants to help society while also running a business at the same time.

Feel free to contact us if you have any questions related to this topic at [email protected]

Fabian Doppler

Connect with me on LinkedIn

Fabian, a founding partner of FRANK Legal & Tax, is a German-trained lawyer with expertise in corporate/commercial and real estate law, and litigation, and has been living and working in Thailand since 2005.