New Land and Building Legislation in 2020

Comments Off on New Land and Building Legislation in 2020After an extensive legislative process, the National Legislative Assembly (NLA) has recently passed the new Land and Building Act (the “Act) comprising 94 Sections and introducing a new system on property taxation. With its announcement in the Royal Gazette, the Act will replace the old and outdated Land and House Tax Act B.E. 2475 (1932).

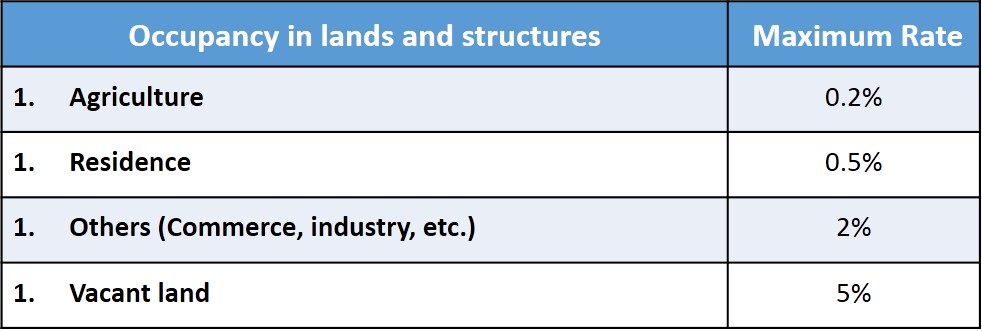

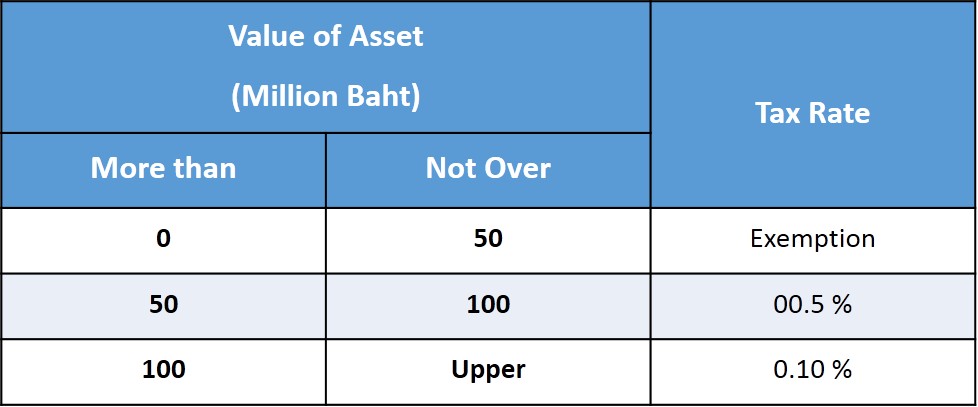

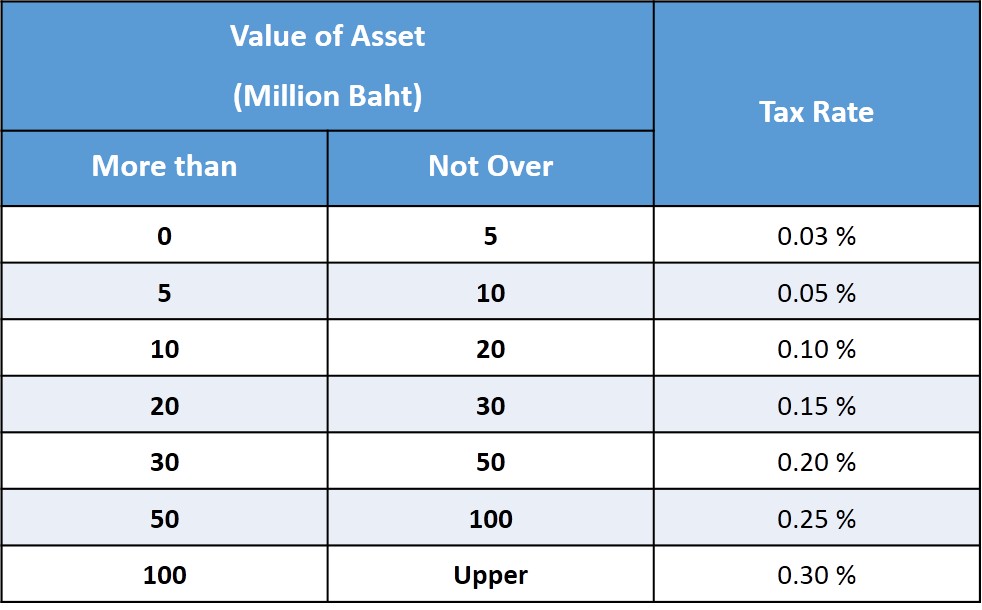

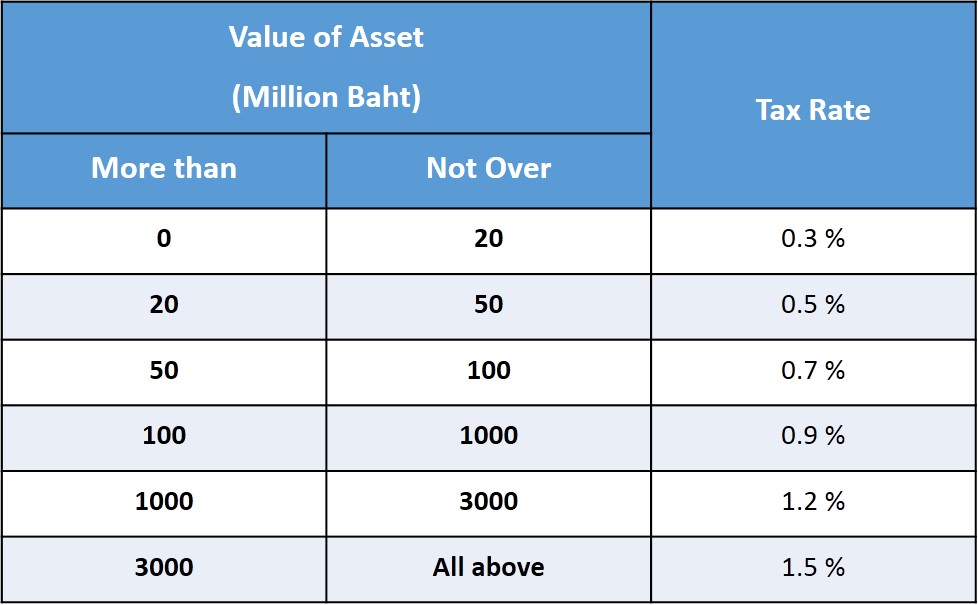

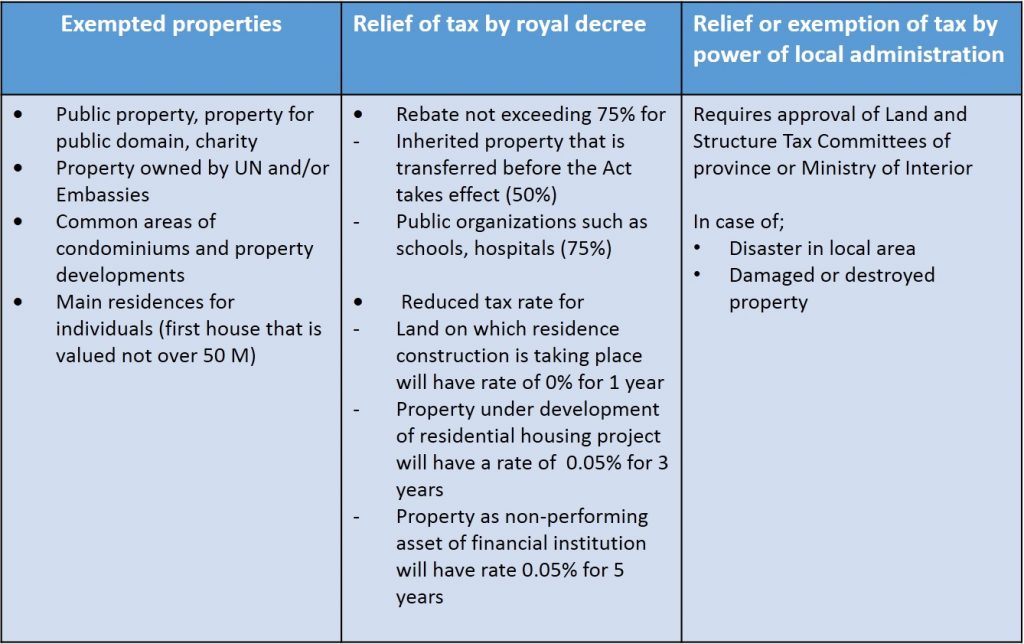

The new system on property taxation includes a legal ceiling rate which depends on the category and the appraised value of the land; a tax exemption might be granted in specific cases:

- Legal ceiling rate for residences: 0,3 % / tax exemptions for first homes

- Legal ceiling rate for agricultural land: 0,15 % / tax exemption for agricultural land held by individuals

- Legal ceiling rate for other purposes: 1,2 %

- Legal ceiling rate for undeveloped land: 1,2 %

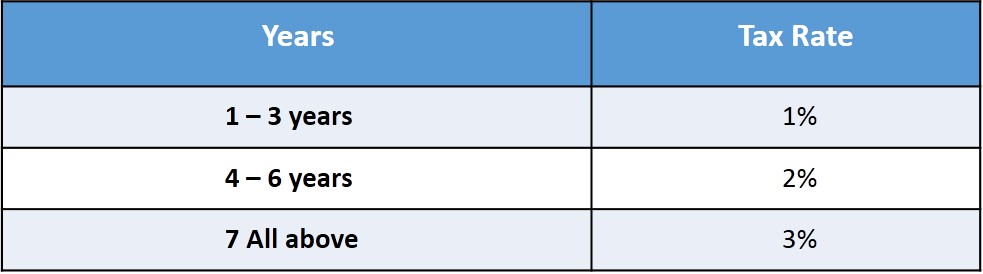

The rates above show the maximum rates under the Act only. Again, the final tax rate is based on the land category and the appraised value of the land. These rates will be increased by 0,3 % every three years. However, the ceiling rate of 3 % will be not exceeded.

The tax collection will start in 2020. According to Deputy Finance Minister Wisudhi Srisuphan, the new system will stimulate the economy and the budget will help the local administrations to enhance the development of their areas.