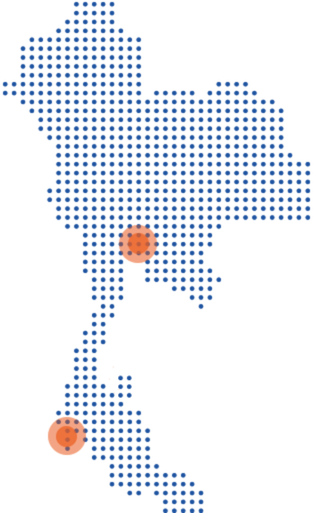

FRANK Legal & Tax represents investor during acquisition of 100+ room key hotel in Thailand

FLT represents an investor to complete the purchase of a 100+ room key hotel in a resort location in Phuket. FLT were responsible for the contracts and negotiations, due diligence and real estate matters. The hotel is currently under construction.